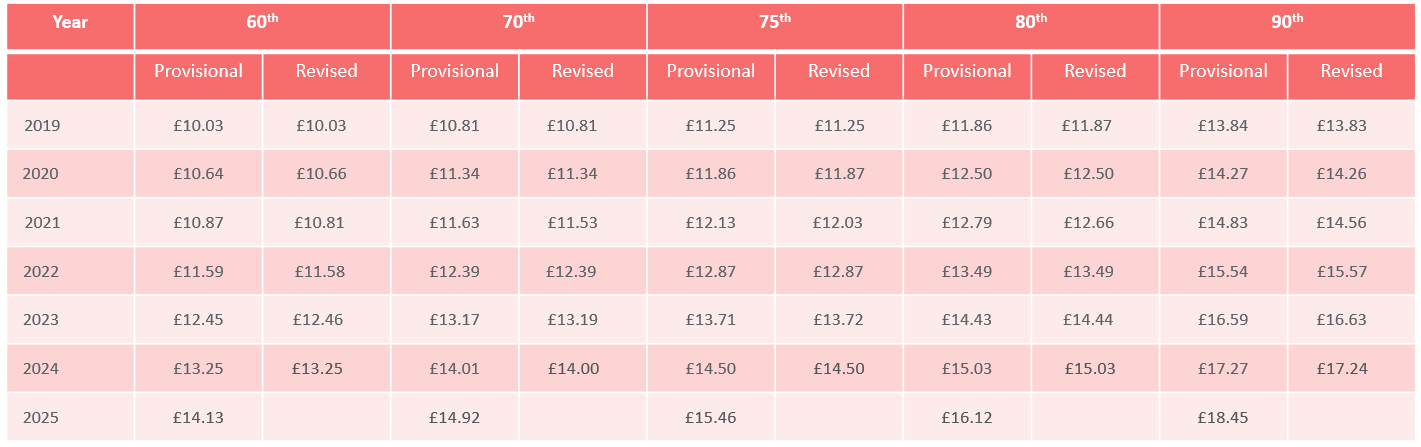

The Office for National Statistics has today (23/10/2025) published the latest figures from the Annual Survey of Hours and Earnings (ASHE). These include the revised figures for 2024 and the provisional figures for 2025. The key index for those administering Periodical Payment Orders (PPOs) is ASHE 6115, which is an index based on an amalgamation of care earnings data from two Standard Occupational Classifications (SOC).

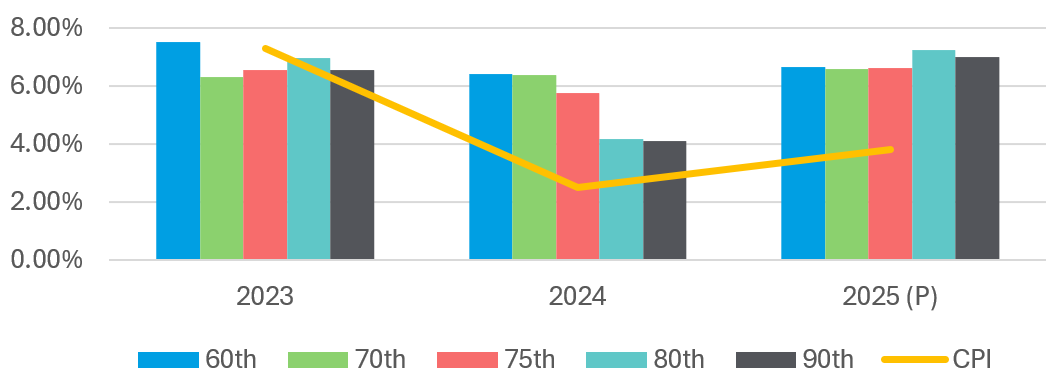

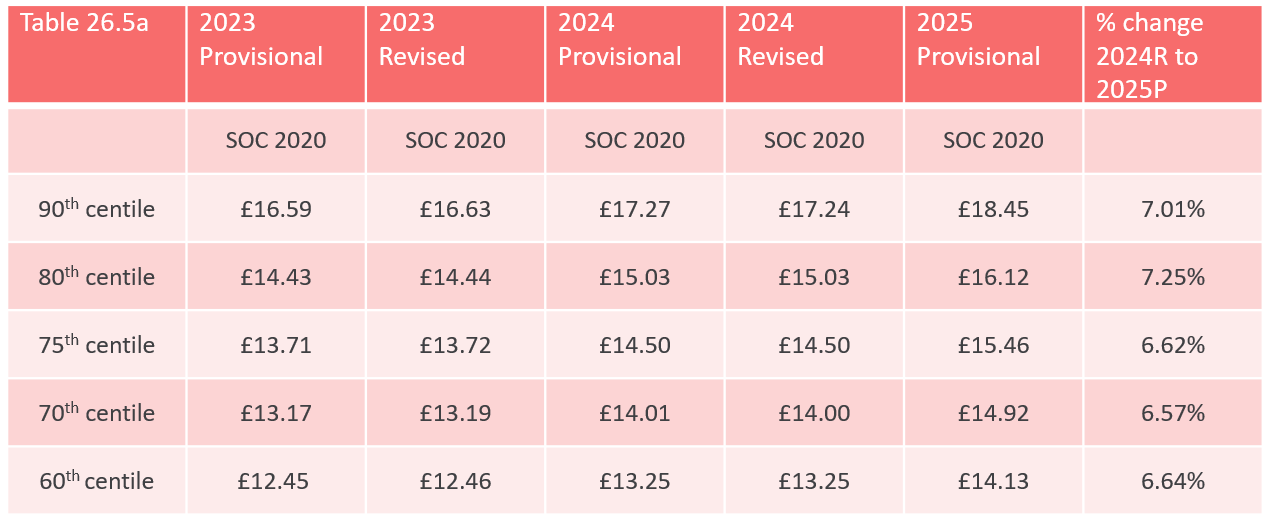

The headline is a 7.25% increase on the 80th centile with an average increase of 6.82% across the 60th to 90th centiles. These increases are higher than in 2024 when they were 4.16% and 5.36% respectively..

Click here for the full table 26.5a.

The extent of these increases (6.82%) is not unexpected and they are broadly comparable with Keoghs’ own analysis of agency care rates (6.9%) which is based on the first six months of 2025. This analysis will be reviewed in January 2026.

As is widely reported, there remains a shortage of workers in the care sector. These increases in hourly rate will of course mean a corresponding increase in the value of periodical payments that fall to be paid this year. Those regularly dealing with cases involving large packages of care and fully versed in the ongoing challenges of recruiting suitable carers will not be surprised by the increase, although as ever the increasing costs of agency care when compared to what carers are actually paid is worth scrutiny

Increases in hourly rates at this level will continue to be referred to by claimant’s legal teams when arguing that a PPO represents the best way of awarding damages for future care. Of course, the arguments for and against a PPO as a form of award are more nuanced than that and remain very case specific.

The current CPI and RPI rates are 3.8% and 4.5% respectively.

The National Living Wage figure (for those aged 21 and over) rose to £12.21 from April 2025 which was an increase of 6.7%. That increase will not be reflected in the ASHE 2025 release as the data collection period ends in April 2025. This is likely to drive up overall costs as is the increase in Employer NI contributions from 13.8% to 15% in April 2025. However, these increases will be reflected in the ASHE 2026 release.

The new Employment Rights Bill is expected to become law in late 2025. This might also result in a significant impact on care costs. However, the extent of this will not be known for some time. The National Living Wage will further increase from April 2026, but the figure is not yet known, with recommendations to be submitted from the Low Pay Commission to the Government by the end of October. The Commission has projected a range of £12.55 to £12.86. This increase will be reflected in the ASHE 2027 release.

The graph below compares the ASHE increases for inflation.

The ONS approach to care data recognises that a care package may involve different types of carers and rates. Simply taking an average of all those to produce one ASHE rate would produce a distorted figure based on the same hours all producing the same rate. Instead, ASHE 6115 is based on a weighted calculation which takes into account the different hours at each hourly rate.

In the normal course, the ASHE figures are produced on a provisional basis for the following year at the same time as revised figures are published for the previous year (i.e. a revision of the previous year’s provisional figures). Typically, any difference between the provisional figure one year and the revised figure published the following year is minimal. It can be seen from the table above that the adjustments between the 2024 provisional and revised figures are minimal.

Most periodical payment sums are recalculated around this time of year, based on the latest ASHE 6115 data and ahead of a typical payment due date in mid-December. That recalculation effectively uplifts the original payment sum due under the periodical payment order by the ratio of the new index compared with the old index (meaning the sum owed can go up or down).

If you would like our assistance in relation to PPOs or a discussion more generally around care costs, please do not hesitate to contact us.

The service you deliver is integral to the success of your business. With the right technology, we can help you to heighten your customer experience, improve underwriting performance, and streamline processes.